Severe weather events are testing the resilience of insurance agents and their clients like never before. Storm season is no longer a brief window of time as weather patterns are changing and events are more frequent. For insurance agents, there’s now a year-round reality that demands foresight, flexibility, and clear communication.

To understand how agents are rising to the challenge, we spoke with three people who’ve lived through the worst—and helped others through it, too. Their experiences demonstrate the evolving role of the insurance agent as educator, advocate, and service provider. They’re also clear about the importance of empathy and the need to stay flexible before, during, and after the storm.

Weather watcher with a mission

In Seward, Nebraska, storms don’t just arrive—they roar through like freight trains. Mark Suhr, President of Suhr & Lichty Insurance Agency, knows this better than most. As an independent agent, volunteer firefighter, and trained weather spotter, Suhr is often the first to see a storm coming.

“We get these things called derechos—land hurricanes,” he explains. “They move fast, carry hail, and can span miles. Tornadoes are scary, but Nebraskans are well-versed in responding to those. These new windstorms are different.”

Local knowledge gives his agency a unique edge. While some agents rely on radar or post-storm reports, Suhr’s boots-on-the-ground approach sets him apart. “We focus on a 30-mile radius around our town. That means when a storm hits, we already know which neighborhoods are in trouble,” he explained.

In one particularly destructive storm, Suhr and his team drove through town at sunrise, surveying damage firsthand before the phones even started ringing. By day’s end, they had processed more than 600 client calls.

Communication starts before the first drop

Being a weather fanatic pays off. “We watch the radars. We’re on ham radios. We talk to other fire departments. We know what’s coming,” Suhr says. When storms are forecasted, he proactively reaches out to clients—especially elderly and tech-averse ones—by phone, ensuring everyone is prepared.

a controlled burn for firefighter training

Once the storm passes, he helps clients avoid predatory storm chasers—contractors who swoop in from out of town to secure quick claim assignments. He leverages information from the Nebraska Insurance Department to develop brochures warning clients not to sign anything too soon.

“We had a customer thank us for sending that out,” Suhr says. “He explained that his neighbor had signed over his claim and got stuck in a mess. We want to make sure our clients stay in control of their coverage.”

Education is everything

Suhr’s agency runs annual seminars to get clients prepared. “We cover policy changes, deductibles, replacement cost versus actual cash value—things people don’t remember until it’s too late,” he said. “Industry practices can be confusing, from roof schedules to percentage deductibles, and we work with them to help them understand. People don’t know their $500,000 home with a 2% deductible means $10,000 out of pocket. They think it’s just 2% of a claim. That’s a hard lesson to learn during a disaster,” he said.

Through it all, Suhr remains calm, and when a storm is coming, he’s awake watching the radar. “I’m a micro-sleeper,” he jokes. “Four hours is enough for me. I’m the one on the fire truck, at the scene, in the smoke. We do much more than insure the community—we help people in any way we can.”

“In a catastrophe, clients need a guide.”

—Kathy Fraley, former agency owner

Industry veteran experiences wildfire firsthand

On a dry August afternoon in 2023, the forest around Spokane, Washington, was primed for ignition. Kathy Fraley, former agency owner and industry educator, has lived for nearly two decades in a quiet rural town 18 miles from the city, nestled by a lake and surrounded by dense pine and cedar. With years of experience in commercial insurance, Fraley was enjoying retirement near a Bible camp where she remains active.

Then the wind changed. Within minutes, what had been a distant threat became a roaring wildfire. “I had five minutes to get my dog and two cats out,” she remembered. “The fire was on both sides of the road. My friend was visiting me, and we just jumped in our cars and drove. There was no time to think.”

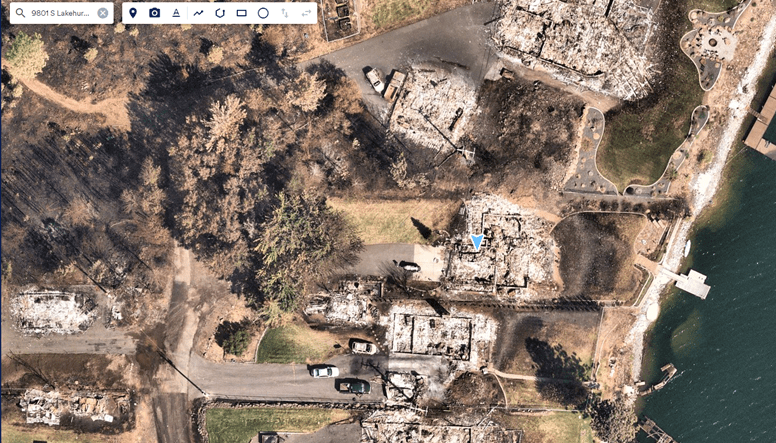

As it turned out, she left just in time. The Gray Fire was a wildfire that burned 10,085 acres. Fraley lost her house and everything in it.

Navigating chaos without a compass

What followed was a surreal journey—not just for Fraley, but for hundreds of neighbors. More than 400 homes and barns were destroyed in the blaze. The fire left scorched land, scattered families, and a housing shortage. “We have multiple universities here, and it was August,” she explained. “Apartments were already taken. Hotels were full. Many in the community were retired on fixed income and a hotel expense was not in the budget. People were desperate.”

Finding housing was more than challenging. The whole area was locked down for a week as firefighters put out hot spots everywhere. “My temporary housing covered renting a place with walls, but there was nothing like that available–especially one that would take three pets. I was lucky that my former agency was able to advocate for me to get consideration for an RV that I could park at the Bible camp which had hook-ups,” she explained.

Fraley also helped the camp organize town meetings and became a resource for her community. “People were looking for clear explanations and advice, beyond the claim number. They needed to understand things like living expenses, debris removal, contents documentation,” she said.

What stood out to her was the importance of empathy and flexibility. The situation on the ground was changing—it was critical for agents and carrier representatives to listen and help people make decisions based on their personal situation and needs.

The experience reinforced something she knew. “It’s so critical for agents to educate clients before a loss ever happens. Explain the policy—what’s covered and what’s not in plain language. Don’t assume they’ll read the fine print,” she said.

Equally important is that agents should contact clients regularly—a minimum of once a year, but hopefully more often, and conduct reviews to make sure people are not underinsured. “Not only do home values change, but the materials and contractor costs increase. Weather patterns and risks may also shift. It’s so important to review and explain all of this to the homeowner. No agency wants to be part of an E&O claim from an insured,” she explained.

Wildfires, unlike hurricanes or tornadoes, don’t always come with days of warning. “You think it won’t happen to you,” she says. “But it only takes one ember to change everything.”

Storm season on the gulf coast

Along the Gulf Coast in Louisiana, hurricane season isn’t a question of if—it’s when. Al Pappalardo, Vice President at Pappalardo Agency, based in Mandeville, just outside New Orleans, lives that reality. “Storms are in our DNA down here,” he said. “After Katrina, everything changed. Expectations changed. Policy language changed. But most importantly, our approach to communication has evolved—fast.”

Gulf Coast hurricanes often come with days of warning and that time is filled with preparation. “You’d be amazed at how many people call two days before a hurricane is heading straight for us asking to review the policy,” he said. “It’s too late by then. We train our staff to communicate early and often.”

Each June, as hurricane season officially begins, Pappalardo’s office knows that at point of sale and on renewal reviews, clients have been prepped. Agents and clients cover everything from verifying deductibles and coverage limits to gathering documentation and reviewing flood policies. “If you wait until the storm season you’ve failed the client and put unreasonable expectations on your team.”

Even with preparation, major hurricanes bring challenges. The agency has invested in texting platforms, remote call forwarding, hot spots for all employees, and a cloud-based management system so the team can work from anywhere—even when the office is without power.

“During Ida, we had team members working from Baton Rouge, Dallas, even Mississippi,” he said. “The key is continuity. It’s important that we’re accessible when our clients need us most.”

And personal touch during a crisis is very important. “Some of our clients want to hear a human voice. They want to talk through their concerns. That’s part of the job,” he said.

The post-storm prescription

When the wind stops, more hard work begins. “We don’t just help people file claims—we help them avoid mistakes,” Pappalardo said. “One of the biggest issues we see is contractor fraud. People are vulnerable, desperate to get back in their homes, and bad actors take advantage.”

The agency sends out post-storm bulletins warning clients about signing contracts too quickly. He explained, “We tell them: If someone’s knocking on your door 12 hours after a storm, be skeptical. If they’re asking for full payment up front—walk away.”

which provided assistance after storms.

The team also spends a lot of time setting realistic expectations. “Everyone wants the adjuster out tomorrow. But in a catastrophe zone, triage matters. Total losses and safety threats come first. We explain that up front,” he said.

After each storm, Pappalardo talks with his team about what can be improved and builds those ideas into his preparation and approach for the next one. “I learned a lot with Katrina. Phones were down; in fact, everything was down. Our server was locked up in a flooded city that the National Guard was protecting,” he explained. “But I had downloaded our book of business to an Excel sheet. Even though it may be old-fashioned, I still do that before every storm to this day. I save the file to a drive now versus printing it out. But no matter what happens, we can always start helping our clients after the storm.”

Pappalardo knows that the future of storm communication will be hybrid: part digital, part one-to-one relationship “Texting platforms are great for speed. AI and apps can streamline claims. But nothing replaces knowing your client—what they value, how they react, who they trust.”

“If you bought a policy online, they might not even know your ZIP code was hit. But we were already out there—driving through the storm zone before the sun was up.”

–Mark Suhr

Steering clients through a complex market

Louisiana, like many coastal states, has seen a major shift in homeowners policies. Named storm deductibles, roof age schedules, and exclusions are common—but not always well understood. “We spend a lot of time educating clients on what their policies actually mean,” Pappalardo said. “We don’t want people surprised by depreciation on older roofs or finding out too late that they don’t have ordinance and law coverage, which helps cover the costs to bring a damaged building up to current building codes.”

In the aftermath of Hurricane Ida, many homeowners learned the hard way that replacement cost didn’t always mean what they thought it did. “It’s not just about the payout,” Pappalardo says. “There are time limits, conditions, repair standards. It can be a dense jungle of fine print,” he said.

He also sees a role for the agent as a community educator. “We’re starting to host town hall-style events. People need to understand how insurance works long before the storm hits. We want to make sure everyone is properly covered, and not disappointed when insurance matters most.”

“You check your shutters, your generator, and you check your policy. That’s how hurricane season works here.”

–Al Pappalardo

A new playbook for storms

Throughout the United States, homeowners face different risks. But insurance agents—no matter the type of storm—share similar challenges: how to keep people informed, safe, and supported through nature’s worst. They know that customer communication isn’t a one-time act, it’s an ongoing responsibility. It means educating clients before disaster, guiding them through confusion, and showing up with empathy when the unexpected hits.

Storm Communication Checklist

These core strategies can help protect your clients and strengthen relationships.

1. Have the storm talk—before it hits the radar

Start storm conversations early. Don’t wait for media coverage to trigger panic. Many homeowners don’t want to think about the worst before it happens, so you may have to find creative ways to talk about their coverage and identify any insurance gaps while there’s time to address them.

2. Stack your communications

Use multiple methods to reach clients. Not everyone is online—or reachable during a disaster. Others are online so much, your messages may get lost in the mix. Use a mashup of emails, texts, phone, and even old-fashioned printed guides and tip sheets to communicate with clients. One agency gives people a small card filled with critical information that can fit in a pocket. And don’t be afraid to repeat messages—many don’t register the first time.

3. Aim for no-pain claims—preparation matters

Well-informed clients have fewer frustrations throughout the claims process. Explain the steps in plain language. Offer checklists for pre-storm prep (photos, receipts, contact info). Review deductibles clearly, including windstorm and named-storm variations, and warn about fraud and storm chasers right after an event.

4. Forecast your risk and response

Consider mapping your client base with geographic risk areas (flood zones, fire zones, tornado paths) so you can quickly identify who may be impacted. The location can help you prioritize outreach post-storm, but it can help customize communications before events. Make sure everyone in the agency will have ready access to client information—leverage cloud storage, hot spots for when internet isn’t available, and even locally-stored lists to keep information safe.

5. Never ghost after the storm

Recovery can take months. Agents can be checking in at regular intervals until the final claim is paid. They can also help homeowners understand deadlines for reimbursements and policy limits—customers may not remember these until they need them. Clients won’t always know every detail of their coverage—but they’ll remember how the agent made them feel.

Leave a comment